Alorh’s eye on the Motherland

Investing in Africa’s Growth: FDI Insights

By Mary Alorh

The African continent is solidifying its status as a leading destination for Foreign Direct Investment (FDI), which plays a pivotal role in driving economic growth in developing regions globally. Investors are increasingly drawn to Africa for its emerging markets and numerous opportunities.

With a youthful and rapidly growing population eager for a diverse range of goods and services, along with a burgeoning middle class, Africa offers significant potential for multinational corporations. The establishment of the African Continental Free Trade Area (AfCFTA) has been a positive development by African governments.

FDI in Africa is predominantly focused on sectors with inherent advantages, such as natural resources, and those with high growth prospects, including construction and telecommunications. In 2023, FDI flows to Africa held steady at US$48 billion, representing only 3.5 percent of global FDI, fueled primarily by strong growth in nations such as Kenya.

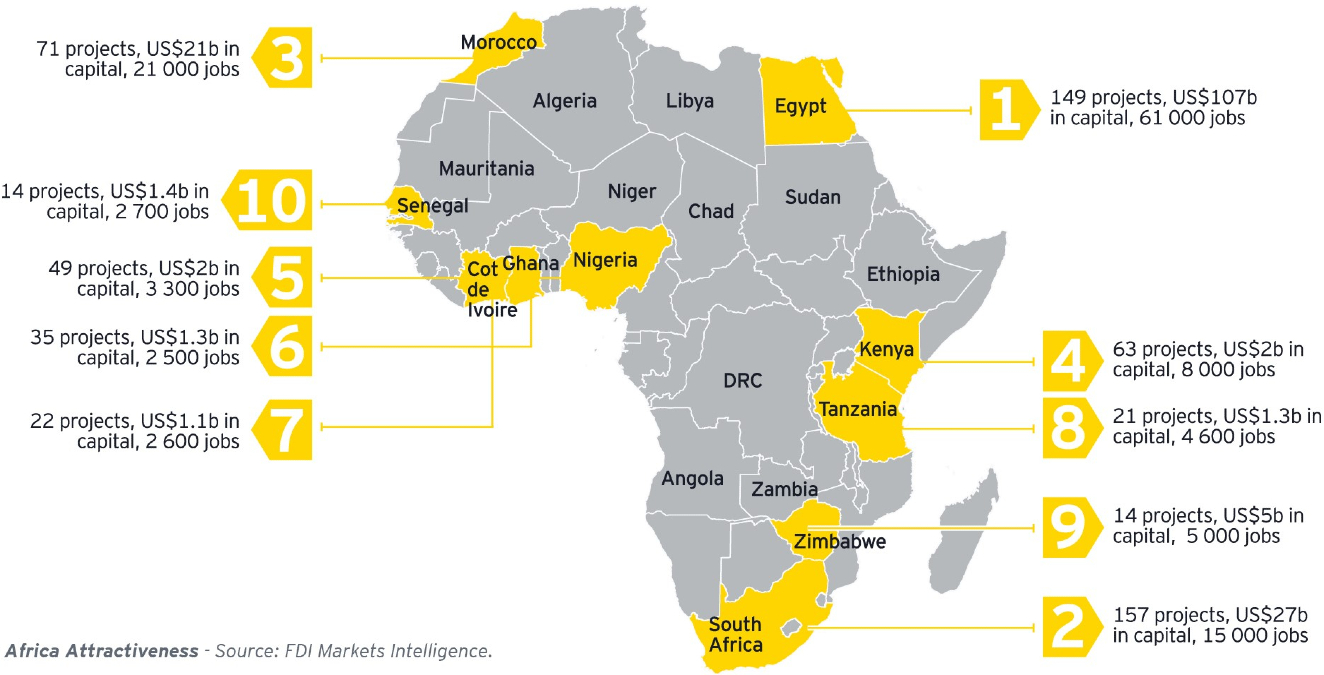

Nevertheless, FDI distribution across Africa remains uneven. Egypt, for example, doubled its FDI intake in 2023 to US$11 billion, while Morocco saw a decrease, with FDI falling to US$2.1 billion, marking a 6 percent drop.

While the United States leads in terms of project investments in Africa, it trails the UAE, France, and India regarding per capita investment. In 2022, UAE investment reached US$50 billion – around eight times that of the US.

By investing in technological infrastructure and leveraging artificial intelligence, Africa can overcome many challenges in areas like agriculture, healthcare, manufacturing, and infrastructure, unlocking new growth potential.

FDI inflows to Africa are projected to decline by 3 percent in 2024, mirroring global trends, as developing regions across Asia, the Caribbean, and others have experienced a 7 percent decrease. Contributing factors to this decline include political instability, such as coups, the resurgence of conflict in Gaza, and the ongoing Russia-Ukraine war, which have added to economic difficulties already exacerbated by the COVID-19 pandemic.

African nations have implemented unique strategies to attract FDI. For instance, Ivory Coast (Côte d’Ivoire) is focusing on its growing agribusiness sector, while Ethiopia is promoting its manufacturing industry to lure investors.

In 2023, the top ten African countries for FDI included Egypt (US$9 billion), South Africa (US$5 billion), Ethiopia (US$3.2 billion), Uganda (US$2.8 billion), Senegal (US$2.6 billion), Mozambique (US$2.5 billion), Namibia (US$2.3 billion), Nigeria (US$1.8 billion), Côte d’Ivoire (US$1.7 billion), and the Democratic Republic of Congo (US$1.6 billion).

Despite these successes, Africa faces hurdles in attracting the breadth of investments needed for comprehensive development. Challenges such as corruption, political instability, and inadequate infrastructure deter some investors. Addressing these issues is essential for achieving sustainable growth.

By investing in technological infrastructure and leveraging artificial intelligence, Africa can overcome many challenges in areas like agriculture, healthcare, manufacturing, and infrastructure, unlocking new growth potential.

Mary Alorh is Director of Administration at DefSEC Analytics Africa Ltd., and is an expert in Gender, Youth, and Peace & Security initiatives in West Africa.