Business

Kenya Adopts Pan-African Payment System to Reduce Reliance on US Dollar

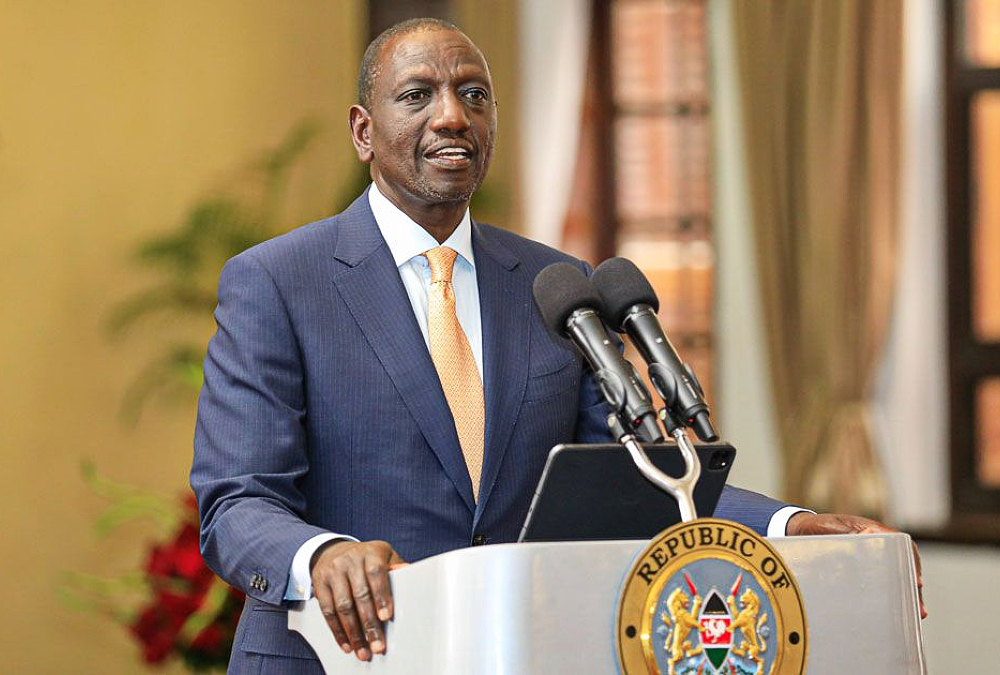

Kenyan President William Ruto’s push to reduce reliance on the US dollar in African trade has gained traction with the launch of the Pan-African Payments Settlement System (PAPSS) in Kenya.

Supported by Afreximbank and the African Union, PAPSS enables traders to conduct intra-African transactions in local currencies, eliminating the need for third-party currencies like the dollar or euro.

Launched in January 2022, PAPSS facilitates instant payments, reducing costs and easing trade across Africa’s 42 currencies. Currently, Nigeria, Liberia, Sierra Leone, Ghana, Guinea, Gambia, Kenya, Djibouti, Zimbabwe, and Zambia are integrated, with plans to onboard all African nations.

President Ruto emphasized the need for a seamless intra-African trade system, stating, “Why are we introducing dollars into our trade? It should be possible to do business without worrying about currency differences.” He pledged Kenya’s commitment to championing PAPSS under the African Continental Free Trade Area (AfCFTA).

Outgoing Afreximbank President Benedict Oramah highlighted PAPSS’s potential to save African businesses US$5 billion annually in transaction costs. By eliminating reliance on external correspondent banks, the system alleviates foreign exchange pressures on African central banks.

Supervised by African central banks and headquartered in Cairo, PAPSS only facilitates legal tender exchanges, excluding digital assets like cryptocurrencies. The Central Bank of Kenya (CBK) has yet to join, though Governor Kamau Thugge noted that PAPSS could help address foreign exchange shortages and open new trade opportunities under AfCFTA.

As of mid-2022, PAPSS had eight central banks, 28 commercial banks, and six financial switches in its network, with all commercial banks expected to join by 2025.